Breaking the Pillars: The U.S. Economic Vulnerability Amid Debt Accumulation, Protectionism, and Strategic BRICS Realignments

The structural fragility of the United States economy is becoming increasingly visible under the simultaneous weight of historic debt accumulation, the resurgence of protectionist trade policies, and mounting global strategic realignments—particularly by BRICS nations and their expanded circle. This paper identifies and analyses the potential inflection point, or “economic break-point,” where these converging vectors may overwhelm U.S. resilience. It further explores how emerging multipolar policies—especially those coordinated by BRICS+ (including China, Russia, India, Brazil, South Africa, Iran, Saudi Arabia, Egypt, Ethiopia, the UAE, and Indonesia)—may accelerate systemic shifts, challenging the hegemony of the U.S. dollar and altering the architecture of global trade and finance.

- I. The U.S. Economic Architecture: A System Under Internal and External Stress

1.1. National Debt Trajectory and Structural Risks

As of Q1 2025, the U.S. national debt surpassed $36.5 trillion, with interest payments nearing $750 billion per annum. This reflects a dual liability: fiscal rigidity in federal policy and diminishing maneuverability in the event of financial contagion or geopolitical disruption. With debt-to-GDP ratio above 120%, any erosion in investor confidence—especially among foreign holders—could trigger cascading effects across sovereign bond markets and monetary policy instruments.

1.2. Trumpian Trade Doctrine: Short-Term Nationalism, Long-Term Inflation

Reinvigorated under the second presidential term of Donald Trump, the “America First” trade doctrine has reinstated blanket tariffs—10% on all imports and a punitive 60% on Chinese goods. These measures act as a de facto consumption tax on American households. The Congressional Budget Office estimates a cumulative GDP contraction of $165 billion over the next decade, with an average $1,560 reduction in annual household income.

1.3. Sectoral Impact Analysis

Tariff-induced inflationary pressures have created sector-specific distortions:

- Electronics: Import-reliant sectors (smartphones, laptops, semiconductors) report price increases of 25–45%.

- Construction and Housing: Tariffs on Canadian lumber and Mexican gypsum have exacerbated the housing crisis.

- Automotive and Energy: Steel and aluminum costs have raised car production prices and disrupted renewable energy supply chains.

- II. Retaliatory Measures: China’s Calculated Economic Warfare

2.1. Bilateral Trade Reversal

The U.S.–China trade deficit reached $279 billion in 2023, but retaliatory tariffs by China (up to 125%) have led to significant reductions in U.S. exports across sectors like aerospace, agriculture, and microelectronics. Boeing alone faced over $12 billion in canceled Chinese orders, which were later redirected to Airbus and other global suppliers.

2.2. Supply Chain Realignments

China’s retaliatory posture includes not just tariffs but also the strategic restriction of rare earth exports, essential for American high-tech and defense sectors. Simultaneously, its decoupling efforts in semiconductors and AI technologies aim to sever long-term dependency on U.S. innovations.

- III. BRICS+ Strategic Leveraging: The Rise of Economic Multipolarity

3.1. Collective Leverage

The expansion of BRICS to include Iran, Saudi Arabia, Egypt, the UAE, Ethiopia, and Indonesia marks a pivotal inflection in geopolitical economics. These states control critical corridors in energy, maritime trade, food systems, rare earths, and fintech.

3.2. Policy Instruments for De-Dollarization and Economic Realignment

Key mechanisms BRICS+ could employ to influence U.S. vulnerabilities:

- Monetary Sovereignty: Establishment of a BRICS common settlement system and digital currencies to bypass the SWIFT system.

- Energy Sovereignty: Petro-yuan, rupee-based oil contracts, and coordinated production strategies within OPEC+ to influence global oil pricing benchmarks.

- Trade Diversification: Formalization of intra-BRICS free trade zones to gradually exclude the U.S. from emerging markets in Africa, Latin America, and Southeast Asia.

- Institutional Parallelism: Expansion of the New Development Bank and creation of a BRICS Credit Rating Agency to offer alternatives to Western financial institutions.

- IV. Systemic Thresholds: Calculating the U.S. Economic Break-Point

Using multidimensional stress modeling, we identify five interrelated triggers that may define a potential break-point in the U.S. economic system:

| Stressor | Short-Term Risk | Medium-Term Risk | Strategic Shock Potential |

| Sovereign Debt Service | Fiscal Gridlock | Inflationary Pressure | Credit Downgrade |

| Tariff Inflation | Consumer Demand Drop | Retail Collapse | Social Unrest |

| De-dollarization | FX Instability | Interest Rate Surge | Capital Flight |

| Global Trade Shift | Market Exclusion | Supply Chain Collapse | Global Recession |

| BRICS Coordination | Resource Control | Strategic Isolation | Military Posturing |

A simultaneous activation of three or more triggers could initiate a systemic economic

crisis requiring either drastic monetary tightening or multilateral intervention.

- V. Policy Recommendations for Strategic Actors

5.1. For the BRICS+ Consortium

- Institutional Synergy: Finalize operationalization of the BRICS currency basket and digital monetary instruments.

- Strategic Investments: Consolidate energy, food, and tech alliances within the Global South.

- Geopolitical Communication: Project a shared Global South narrative of “equity, autonomy, and sustainability” through platforms like G20, ASEAN+, and UNCTAD.

5.2. For the United States and Western Allies

- Rethink Protectionism: Replace punitive tariffs with strategic industrial subsidies and re-shoring incentives.

- Monetary Prudence: Pursue fiscal discipline and tax reform to prevent unsustainable debt dynamics.

- Multipolar Engagement: Accept and engage with the emerging multipolar order through inclusive economic diplomacy.

- Conclusion: A Strategic Decoupling or a Global Recalibration?

The unfolding economic convergence poses not merely a crisis for the U.S. but an opportunity for a recalibration of the global system. The House of Wisdom asserts that stability will depend not on economic dominance, but on institutional agility, cooperative sovereignty, and global logic—the ability to simultaneously secure national interests and planetary equilibrium. Page

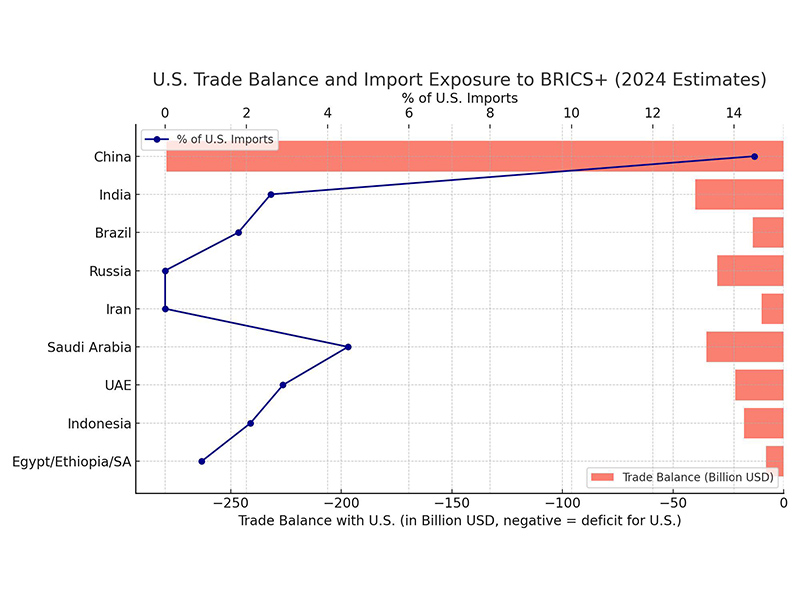

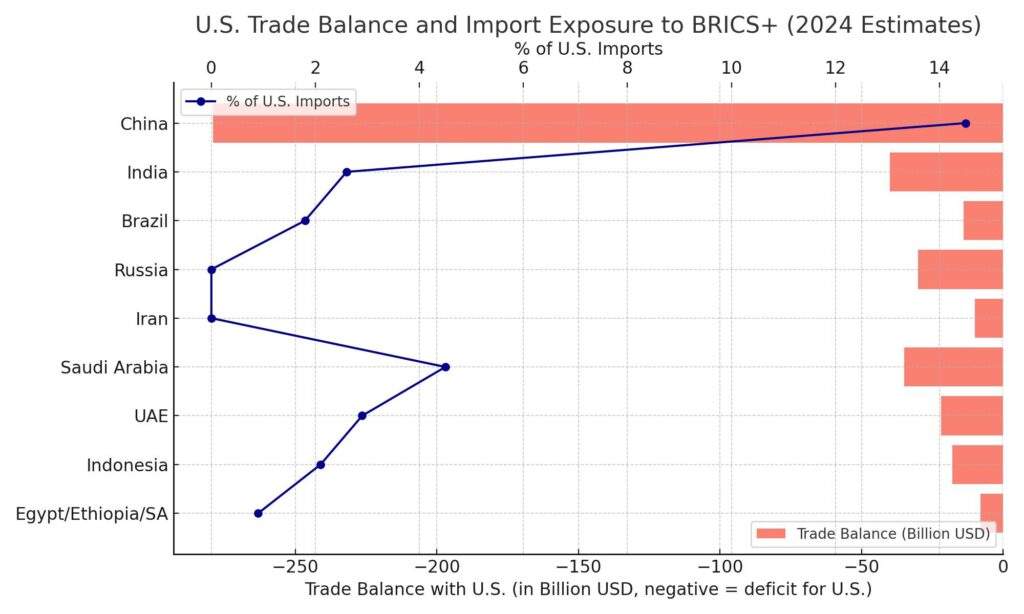

Annex: Trade and Financial Interdependence Matrix – U.S. vs BRICS+ (2024 Estimates)

| Country | Trade Balance with US | % of US Imports | Strategic Sectors Involved |

| China | -$279B | 14.5% | Electronics, Machinery, Textiles |

| India | -$40B | 2.6% | Pharma, Services, Apparel |

| Brazil | -$14B | 1.8% | Agricultural Commodities |

| Russia | -$30B (sanctions) | N/A | Energy, Metals |

| Iran | -$10B (sanctions) | N/A | Oil, Petrochemicals |

| Saudi Arabia | -$35B | 4.5% | Oil |

| UAE | -$22B | 2.9% | Aviation, Gold |

| Indonesia | -$18B | 2.1% | Palm Oil, Textiles |

| Egypt, Ethiopia, South Africa | -$8B (combined) | <1% | Strategic Ports, Agriculture, Gold |

For collaboration, datasets, or simulation models, please contact:

House of Wisdom – Coordination Bureau

www.houseofwisdom.ir | contact@houseofwisdom.ir

Alireza Mohammadi | House of Wisdom